Reimagining Capital for Real-World Decarbonisation: How Do We Fund It?

- Sherry Yin

- May 8, 2025

- 4 min read

Updated: Jul 23, 2025

The climate tech revolution is running on fumes.

At First Impact Partners, we work with founders building truly disruptive climate technologies—from carbon capture concrete to breakthrough battery chemistry. But time and again, we see the same bottleneck: funding the first commercial deployment of these climate-critical technologies. It’s a problem that’s not just urgent, but existential—for startups, investors, and governments alike.

After our last funding structure workshop with policy makers, energy experts and financiers, one thing became clear: the UK and Europe must overhaul how we finance deep decarbonisation if we want to hit our net zero targets. This article presents the second part of our research on the climate tech landscape and innovative funding. It outlines our synthesis of current pain points, introduces our proposed triangle framework, and offers strategic considerations to stakeholders to unlock climate capital at scale. See part one here.

The Funding Problem No One Wants to Own

First-of-its-kind decarbonisation projects are expensive, uncertain, and slow-moving—three red flags for traditional investors. A single commercial-scale plant or infrastructure deployment can easily cost £100 million, yet there’s no dedicated financial instrument or facility to support this unique risk class.

What’s broken:

VCs don’t want to touch capital-intensive hardware: Most climate VC funds seek fast exits and asset-light models due to their typical 10-year life cycle. B2B software is still the favourite child.

Project finance requires stable revenue: Traditional infra financing demands stable long-term cash flows (typically longer than 10 years), but FOAK projects carry high operational and scale-up risks, often without secured long-term offtakes that infra investors are looking for.

Government supports early R&D, not first deployment: Most public funding stops at TRL 6–7, just before commercial scale.

Equity dilution at this stage is brutal: Founders sometimes give up >50% (think uni/accelerator >20%, seed >20%..) of their company before hitting meaningful traction.

The way we talk about subsidies and support mechanisms is often backwards. Fossil fuels still receive $7 trillion globally in subsidies (IMF, 2023), yet clean technologies are penalised for needing transitional support—even though:

Solar only became cheap due to industrial policy (i.e. “implicit” subsidies) from countries like China.

Green hydrogen can beat fossil-based hydrogen when powered by surplus renewables—but only if system-level costs are considered.

EVs now cost the same as ICE vehicles—but that wasn’t true for early adopters who paid the premium.

A New Triangle Framework for Climate Hardware Finance

To unlock funding at scale, we need to blend three principles:

The following financing models align with our Triangle Framework (list is not exhaustive), along with real-world examples illustrating how these models have been applied in practice:

These aren’t standalone. Blended finance weaves them together to align risk, return, and adoption across the ecosystem.

From Fragmentation to Funding Stacks

To deploy hard tech at scale, we need an entirely new capital stack. One that blends the above three principles to match the risk profile of climate infrastructure that is new, but essential.

Blending Layer | Role | Actors | Characteristics |

Top | Follow-on project finance | Institutional investors, infra funds | ~50%-70% (indicative), low-risk |

Middle | De-risked growth equity | Family offices, DFIs | ~20-40% (indicative), mid-risk |

Base | Catalyst Capital | Government, philanthropy, impact-first investors | ~10% (indicative), early-stage, risk-absorbing |

Catalyst capital is the most crucial layer. It’s not “first loss”—a term investors may dislike—but strategic risk insulation. It absorbs technical, regulatory, and market uncertainties that other capital won’t touch. This early buffer is what unlocks the rest of the stack and builds the bridge from prototype to permanence.

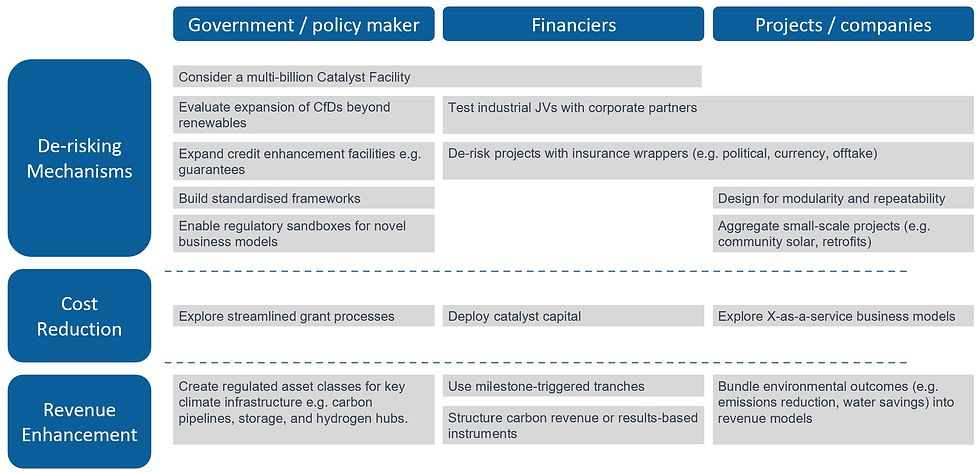

Strategic Considerations for Various Stakeholders

Government & Policy Makers

Catalyst facilities (e.g. Germany’s €100 billion climate plan) are being considered to accelerate deployment of climate infrastructure.

Expanding CfDs beyond renewables could help create demand certainty in sectors such as industrial heat, SAF, and carbon removal.

Credit enhancement mechanisms—such as guarantees or concessional capital—can crowd in private investment.

Standardised legal frameworks (e.g. BVCA) and procurement templates help reduce transaction costs and enable faster execution.

Regulatory sandboxes (e.g. UK’s Ofgem Sandbox) are being used to trial novel business models in controlled environments.

Financiers & Capital Providers

Deploy milestone-triggered tranches to align funding with technical and commercial progress.

Structure carbon-linked or outcome-based instruments to support long-term, performance-driven returns.

Use insurance wrappers (e.g. political, currency, offtake risk) to improve project bankability, particularly in emerging markets.

Apply catalyst capital via portfolio approaches to spread risk across early-stage project cohorts and accelerate learning.

Test industrial JVs with corporates to share development risk and lower the capital intensity of FOAK deployments.

Project Developers & Companies

Aggregate small-scale or distributed assets (e.g. community solar, retrofit portfolios) to achieve investable scale.

Design for modularity and repeatability to enable low-friction replication and attract infrastructure-style capital.

Adopt “X-as-a-Service” models—such as energy-as-a-service, lease-to-own, or pay-per-use—to reduce customer CAPEX and expand market access.

Blend CAPEX and OPEX solutions using a mix of grants, leasing, PPAs, and offtake structures to improve project bankability.

Hardware are fundamental in the climate race—we need to finance it like we mean it.

If you’re building, funding, or shaping policy for climate hardware—we’d love to hear from you.

Follow us for deeper insights into funding climate innovation, or reach out to collaborate on structuring capital stacks for real-world impact.

Disclaimer: This content is for informational purposes only and does not constitute investment advice or a recommendation. We do not take responsibility for any decisions or outcomes resulting from how you choose to use or interpret this information.

Comments